Definition and example of “buy a skyscraper”

Purchasing a skyscraper is a significant financial endeavor involving the acquisition of a high-rise building that typically comprises numerous floors and serves various purposes such as commercial, residential, or mixed-use. Skyscrapers are often landmarks within urban landscapes and represent substantial investments due to their size, complexity, and prime locations.

Importance, benefits, and historical context

The construction and acquisition of skyscrapers hold immense importance for several reasons. Firstly, they provide substantial vertical space within densely populated urban areas, allowing for efficient land utilization and accommodating a large number of occupants or tenants. Secondly, skyscrapers serve as architectural marvels, showcasing innovative designs and engineering prowess, and often become iconic symbols of cities. Thirdly, they contribute to economic growth by creating job opportunities during construction and offering premium office or residential spaces that attract businesses and individuals.

Historically, the development of skyscrapers has been intertwined with advancements in construction technologies and architectural styles. The first skyscrapers emerged in the late 19th century, with the Home Insurance Building in Chicago being widely recognized as the pioneer. Since then, skyscrapers have evolved significantly, incorporating new materials, designs, and sustainable features to meet the demands of modern society.

Transition to main article topics

The complexities involved in purchasing a skyscraper warrant a comprehensive exploration of various aspects, including market trends, legal considerations, financial implications, and ongoing maintenance requirements. Understanding these factors is crucial for investors, developers, and stakeholders involved in skyscraper transactions.

1. Location

When it comes to skyscrapers, location is paramount. Prime locations, such as those in central business districts or near major transportation hubs, offer several advantages that contribute to the building’s value and desirability.

Firstly, prime locations command higher prices. This is because these areas are in high demand due to their accessibility, visibility, and proximity to amenities. Tenants and buyers are willing to pay a premium for the convenience and prestige associated with being located in a prime area.

Secondly, prime locations offer better accessibility. Skyscrapers in these areas are easily accessible by public transportation, making them convenient for tenants and visitors alike. Additionally, prime locations often have well-developed infrastructure, including roads, bridges, and tunnels, ensuring smooth traffic flow and reducing commute times.

Thirdly, prime locations offer better visibility. Skyscrapers in these areas are highly visible, which can be advantageous for businesses looking to attract customers or for residential units seeking scenic views. The visibility factor can also contribute to the building’s overall brand image and recognition.

In summary, location plays a crucial role in determining the value and desirability of a skyscraper. Prime locations command higher prices, offer better accessibility, and provide greater visibility, making them highly sought-after by investors, businesses, and residents alike.

2. Height

The height of a skyscraper is a significant factor to consider when purchasing or investing in one. Taller buildings generally entail higher construction and maintenance costs due to the increased materials, labor, and engineering required. However, they also offer several advantages that contribute to their desirability and value.

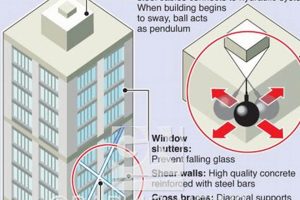

One of the main reasons for the greater cost of taller buildings is the need for specialized construction techniques and materials to ensure structural integrity and safety. Taller buildings are more susceptible to wind loads and seismic activity, necessitating reinforced foundations, stronger building frames, and advanced wind-resistant designs. Additionally, the transportation of materials and equipment to higher floors can be more complex and time-consuming, further increasing construction costs.

Despite the higher costs, taller buildings offer several benefits that make them attractive investments. Firstly, they command higher rental and sale prices due to the prestige and exclusivity associated with living or working in a high-rise building. Taller buildings often offer breathtaking views of the surrounding cityscape, which can be a major selling point for residential and commercial tenants alike.

Moreover, taller buildings can provide tenants with a sense of exclusivity and status. Being located on higher floors can offer a sense of privacy and detachment from the hustle and bustle of the city below. Additionally, taller buildings often have access to premium amenities such as rooftop gardens, fitness centers, and swimming pools, which further enhance their appeal and desirability.

In summary, the height of a skyscraper is a crucial factor to consider when purchasing or investing in one. Taller buildings come with higher construction and maintenance costs, but they also offer greater prestige, views, and exclusivity. Understanding the connection between height and these factors is essential for making informed decisions and maximizing the value of your skyscraper investment.

3. Purpose

The purpose of a skyscraper, whether commercial, residential, or mixed-use, plays a pivotal role in shaping its design, amenities, and tenant mix. Understanding this connection is crucial when considering the purchase of a skyscraper, as it directly impacts the building’s value, functionality, and overall investment potential.

Commercial skyscrapers, designed primarily for office spaces, feature large floor plates, efficient layouts, and advanced technological infrastructure to meet the demands of modern businesses. They often offer amenities such as conference rooms, fitness centers, and on-site dining options to enhance employee productivity and comfort. The tenant mix in commercial skyscrapers typically consists of corporations, financial institutions, and professional services firms seeking a prestigious and convenient work environment.

Residential skyscrapers, on the other hand, are designed to provide comfortable and luxurious living spaces. They feature a wide range of unit types, from studios to penthouses, and offer amenities such as swimming pools, fitness centers, and rooftop terraces to cater to residents’ lifestyles. The tenant mix in residential skyscrapers typically includes individuals, families, and investors seeking a combination of urban convenience and high

-end living.

Mixed-use skyscrapers combine commercial and residential spaces within a single building. This hybrid approach offers flexibility and convenience, attracting a diverse tenant mix that may include businesses, residents, and retail establishments. Mixed-use skyscrapers often feature shared amenities, such as lobbies, fitness centers, and outdoor spaces, fostering a vibrant and interconnected community.

In conclusion, understanding the purpose of a skyscraper and its impact on design, amenities, and tenant mix is essential for informed decision-making. Whether seeking investment opportunities, business premises, or a luxurious living space, carefully considering the intended purpose will guide buyers towards skyscrapers that align with their specific needs and objectives.

4. Tenants

In the context of purchasing a skyscraper, securing high-quality tenants with long-term leases is paramount to ensuring stable income generation and maximizing the building’s value. Tenants serve as the foundation of a skyscraper’s financial performance, and their presence and commitment play a significant role in attracting and retaining investors.

- Tenant Quality: High-quality tenants are financially stable businesses or individuals with a proven track record of timely rent payments and responsible occupancy. They often have strong credit ratings, positive references, and a commitment to maintaining a professional and respectful relationship with the landlord.

- Lease Terms: Long-term leases provide stability and predictability to income generation. By securing tenants with multi-year lease agreements, landlords can lock in rental rates and minimize the risk of vacancy and tenant turnover. This stability is particularly important for skyscrapers, which typically require substantial operating expenses and maintenance costs.

- Tenant Mix: A diverse tenant mix can mitigate risk and enhance a skyscraper’s overall appeal. Landlords should aim for a balance of tenants from different industries and sectors to reduce the impact of economic downturns or industry-specific challenges. A mix of commercial, residential, and retail tenants can also create a vibrant and dynamic building environment.

- Tenant Amenities: Providing high-quality amenities such as fitness centers, conference rooms, and rooftop terraces can attract and retain high-value tenants. By offering amenities that cater to tenants’ needs and enhance their experience, landlords can differentiate their skyscraper from competitors and command higher rental rates.

In summary, securing high-quality tenants with long-term leases is a cornerstone of successful skyscraper ownership. Landlords should prioritize tenant screening, negotiate favorable lease terms, cultivate a diverse tenant mix, and invest in tenant amenities to maximize income generation and ensure the long-term success of their skyscraper investment.

5. Construction Costs

Construction costs are a crucial factor to consider when purchasing a skyscraper. They can vary significantly depending on several factors, including the choice of materials, labor costs, and the complexity of the building’s design.

The materials used in the construction of a skyscraper have a significant impact on its overall cost. High-quality materials, such as reinforced concrete, steel, and glass, are more expensive than lower-quality materials, but they also provide greater durability and longevity. The labor costs associated with skyscraper construction can also be substantial, as skilled workers are required for the safe and efficient assembly of these complex structures.

The design of a skyscraper also plays a significant role in determining its construction costs. Complex designs, such as those involving unique shapes or intricate facades, require specialized engineering and construction techniques, which can increase the overall cost. Additionally, the height of a skyscraper can also impact construction costs, with taller buildings generally requiring more materials and labor to construct.

Understanding the connection between construction costs and the purchase of a skyscraper is essential for making informed investment decisions. Buyers should carefully evaluate the materials, labor costs, and design complexity involved in the construction of a skyscraper to accurately assess its overall cost and potential return on investment.

6. Maintenance Costs

Maintenance costs are an integral part of skyscraper ownership and are directly connected to the purchase of such a property. These costs can be substantial and must be carefully considered when evaluating the overall investment.

Ongoing maintenance encompasses a wide range of tasks, including repairs, cleaning, and security, all of which are essential for preserving the building’s value and ensuring the safety and well-being of its occupants. Repairs may include addressing structural issues, fixing mechanical systems, or replacing worn-out components. Cleaning involves regular upkeep of common areas, windows, and the building’s exterior to maintain a professional and inviting appearance.

Security costs are also significant, as skyscrapers require robust security measures to protect tenants, visitors, and assets. This may include hiring security personnel, installing surveillance systems, and implementing access control measures. The height and complexity of skyscrapers often necessitate specialized equipment and expertise for maintenance and repairs, further contributing to the overall costs.

Understanding the connection between maintenance costs and skyscraper ownership is crucial for informed decision-making. Investors and buyers should diligently assess these costs and factor them into their financial projections. Proper budgeting for maintenance ensures that the building remains in good condition, attracts and retains tenants, and maintains its value over the long term.

Neglecting maintenance costs can have severe consequences. Deferred repairs can lead to more significant structural issues, reduced tenant satisfaction, and diminished property value. Conversely, proactive maintenance can extend the building’s lifespan, enhance its appeal to tenants, and contribute to a positive return on investment.

7. Legal Considerations

Before purchasing a skyscraper, it is crucial to understand the legal considerations that impact its development and operations. Zoning laws, building codes, and environmental regulations play a significant role in shaping the design, construction, and management of skyscrapers.

- Zoning Laws

Zoning laws define how land can be used in a specific area. They determine the permissible height, size, and use of buildings, ensuring orderly development and compatibility with the surrounding neighborhood. Zoning laws impact skyscrapers by regulating their height, setbacks, and density, influencing t

heir overall design and impact on the cityscape. - Building Codes

Building codes establish minimum standards for the construction and maintenance of buildings, ensuring structural safety, fire protection, and accessibility. Skyscrapers, due to their height and complexity, must adhere to stringent building codes. These codes govern aspects such as structural design, fire safety systems, and energy efficiency, ensuring the safety and well-being of occupants and the longevity of the building.

- Environmental Regulations

Environmental regulations aim to protect the environment and mitigate the impact of development on natural resources. Skyscrapers, with their significant energy consumption and potential environmental footprint, must comply with these regulations. They may involve measures such as energy-efficient design, waste management plans, and adherence to air quality standards. Understanding environmental regulations is crucial for sustainable skyscraper development and minimizing the building’s ecological impact.

Navigating the legal considerations associated with skyscrapers requires careful planning and collaboration with architects, engineers, and legal counsel. Adherence to zoning laws, building codes, and environmental regulations ensures compliance, avoids costly delays or penalties, and contributes to the long-term success of a skyscraper investment.

8. Market Conditions

The connection between market conditions and the purchase of a skyscraper is undeniable. Real estate market conditions, characterized by the interplay of supply and demand, directly influence pricing and, consequently, investment returns.

When supply exceeds demand, a buyer’s market emerges, leading to lower prices and increased negotiation power for potential purchasers. In such conditions, investors may find opportunities to acquire skyscrapers at favorable terms. Conversely, when demand outstrips supply, a seller’s market takes hold, resulting in higher prices and potentially higher returns for those selling their skyscraper investments.

Understanding market conditions is crucial for informed decision-making. Investors should carefully analyze market trends, vacancy rates, and economic forecasts to gauge the optimal time to buy or sell a skyscraper. By aligning their investment strategy with market conditions, investors can maximize their returns and minimize risks.

Real-life examples abound that underscore the impact of market conditions on skyscraper investments. During the 2008 financial crisis, a glut of skyscrapers on the market led to a significant drop in prices, creating opportunities for savvy investors to acquire prime properties at a discount. Conversely, the strong economic growth in the mid-2010s fueled a surge in demand for skyscrapers, pushing prices to record highs and generating substantial returns for investors.

The practical significance of understanding the connection between market conditions and skyscraper purchases cannot be overstated. It empowers investors to make informed decisions, capitalize on market opportunities, and navigate market cycles to achieve their financial goals.

In conclusion, market conditions play a pivotal role in the pricing and investment returns associated with skyscrapers. By carefully considering the dynamics of supply and demand, investors can position themselves to make astute investment decisions and optimize their returns in the ever-changing real estate market.

FAQs on Purchasing a Skyscraper

Prospective buyers venturing into the realm of skyscraper acquisitions often encounter a multitude of questions. This section aims to provide clear and concise answers to some of the most frequently asked questions, empowering individuals with the knowledge they need to make informed decisions.

Question 1: What are the key considerations when purchasing a skyscraper?

A: Several crucial factors come into play when purchasing a skyscraper, including location, height, intended purpose, quality of tenants, construction and maintenance costs, legal considerations, and prevailing market conditions. A comprehensive understanding of these aspects is essential for a successful investment.

Question 2: How does a skyscraper’s location impact its value?

A: Location is paramount in skyscraper investments. Prime locations in central business districts or near major transportation hubs command higher prices due to accessibility, visibility, and proximity to amenities, positively influencing the building’s overall value and desirability.

Question 3: What are the advantages of investing in taller skyscrapers?

A: Taller skyscrapers offer several benefits, including commanding higher rental and sale prices due to the associated prestige and exclusivity. They provide breathtaking views, a sense of status, and access to premium amenities, making them highly sought-after by businesses and residents alike.

Question 4: How does a skyscraper’s intended purpose affect its design and functionality?

A: The intended purpose of a skyscraper, whether commercial, residential, or mixed-use, significantly influences its design and functionality. Commercial skyscrapers prioritize large floor plates and efficient layouts for office spaces, while residential skyscrapers focus on comfortable living spaces with amenities. Mixed-use skyscrapers combine both commercial and residential elements, offering flexibility and convenience.

Question 5: Why is securing high-quality tenants crucial for skyscraper investments?

A: High-quality tenants are the cornerstone of stable income generation and value appreciation for skyscraper investments. They provide long-term lease commitments, ensuring a steady stream of rental income. Moreover, their presence enhances the building’s reputation and attracts other reputable tenants, creating a positive feedback loop.

Question 6: How do market conditions influence the purchase of a skyscraper?

A: Market conditions, characterized by supply and demand dynamics, directly impact skyscraper pricing and investment returns. In a buyer’s market, lower prices and increased negotiation power favor purchasers, while in a seller’s market, higher prices and potentially higher returns benefit sellers. Understanding market conditions is essential for making informed investment decisions.

In summary, purchasing a skyscraper involves careful consideration of various factors, including location, height, purpose, tenants, costs, legal aspects, and market conditions. By thoroughly understanding these elements, investors can make strategic decisions that align with their financial objectives and maximize their investment potential.

As you embark on your skyscraper investment journey, remember to conduct thorough research, consult with experts, and stay informed about market trends. With a well-informed approach, you can navigate the complexities of skyscraper ownership and achieve your investment goals.

Tips for Purchasing a Skyscraper

Acquiring a skyscraper is a complex and multifaceted endeavor. To enhance your chances of success, consider the following tips:

Tip 1: Secure Financing Early On

Obtaining financing for a skyscraper is a crucial step. Initiate the process early to secure favorable terms and interest rates. Explore various financing options and consult with financial experts to determine the best strategy for your investment.

Before finalizing the purchase, conduct comprehensive due diligence on the skyscraper. This includes reviewing financial statements, legal documents, and property inspections. Identify any potential issues or liabilities that may impact the value or viability of your investment.

Tip 3: Understand Market Dynamics

Stay informed about market trends and economic conditions that may influence the skyscraper’s performance. Analyze supply and demand factors, rental rates, and occupancy levels to make informed decisions about pricing and lease terms.

Tip 4: Secure High-Quality Tenants

Attracting and retaining reputable tenants is essential for stable income generation. Establish clear tenant selection criteria and negotiate favorable lease agreements that align with your investment goals. Offer competitive amenities and services to enhance tenant satisfaction and retention.

Tip 5: Prioritize Long-Term Value

Focus on acquiring a skyscraper with long-term value potential. Consider factors such as location, design, and sustainability features that will contribute to the building’s desirability and resilience over time. Avoid making decisions solely based on short-term gains.

Tip 6: Engage Experienced Professionals

Throughout the process, seek guidance from experienced professionals, including real estate brokers, attorneys, and property managers. Their expertise can help you navigate complex legal and financial aspects, ensuring a smooth and successful transaction.

Tip 7: Consider Joint Ventures

Explore the possibility of forming joint ventures with other investors. This strategy can provide access to additional capital, expertise, and risk diversification. However, carefully evaluate the terms of the joint venture agreement and ensure alignment with your investment objectives.

Tip 8: Stay Informed and Adaptable

The real estate market is constantly evolving. Stay abreast of industry trends, technological advancements, and regulatory changes that may impact your skyscraper investment. Be adaptable and willing to adjust your strategy as needed to maintain a competitive edge.

By adhering to these tips, you can increase your chances of making a sound investment decision and maximizing the potential return on your skyscraper purchase.

Conclusion

Purchasing a skyscraper is a sophisticated investment that demands a comprehensive understanding of various factors, including location, height, purpose, tenants, costs, legal considerations, and market conditions. Each of these elements plays a crucial role in determining the value, desirability, and long-term success of your skyscraper investment.

Skyscrapers, as iconic landmarks and testaments to architectural prowess, offer a unique blend of prestige, functionality, and investment potential. By carefully considering the key points outlined in this article and seeking guidance from experienced professionals, you can navigate the complexities of skyscraper acquisition and make informed decisions that align with your financial goals.

Remember, investing in a skyscraper is not merely a transaction; it is an opportunity to acquire a piece of architectural history, contribute to the cityscape, and generate long-term financial returns. Approach this endeavor with a discerning eye, a strategic mindset, and a commitment to due diligence, and you will position yourself for success in the world of skyscraper ownership.