Abandoned skyscrapers for sale are unoccupied, often derelict high-rise buildings that are available for purchase. They can be found in cities around the world, and their sale can be a complex and challenging process.

Abandoned skyscrapers can be a valuable investment for developers and investors. They offer the potential for significant returns, as they can be converted into residential, commercial, or mixed-use properties. However, there are also a number of risks associated with investing in abandoned skyscrapers. These risks include the potential for environmental contamination, structural problems, and legal issues.

Despite the risks, abandoned skyscrapers can be a rewarding investment. With careful planning and execution, they can be transformed into vibrant and successful properties. Before investing in an abandoned skyscraper, it is important to conduct thorough due diligence and to consult with experts in the field.

1. Location

The location of an abandoned skyscraper is a key factor in determining its value and potential for redevelopment. Skyscrapers in desirable urban areas are more likely to be redeveloped and generate higher returns. There are a number of factors to consider when evaluating the location of an abandoned skyscraper, including:

- Proximity to amenities: Skyscrapers that are located near amenities such as public transportation, shopping, and dining are more desirable to potential buyers and tenants.

- Zoning: Zoning laws can restrict the use of abandoned skyscrapers, so it is important to understand the zoning regulations for the area where the property is located.

- Crime rate: The crime rate in the area where the skyscraper is located can also affect its value. Investors are less likely to purchase properties in areas with high crime rates.

- Future development plans: It is important to consider any future development plans for the area where the skyscraper is located. New development can affect the value of the property, both positively and negatively.

By carefully considering the location of an abandoned skyscraper, investors can make informed decisions about whether or not to purchase the property.

2. Condition

The condition of an abandoned skyscraper is a key factor in determining its value and potential for redevelopment. Buildings that are in good condition will require less investment to redevelop, while buildings that are in poor condition may be difficult or impossible to redevelop.

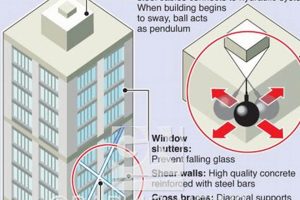

- Structural integrity: The structural integrity of an abandoned skyscraper is paramount. Buildings that have been damaged by fire, earthquakes, or other events may be unsafe to occupy and may require extensive repairs.

- Exterior condition: The exterior condition of an abandoned skyscraper can also affect its value. Buildings with crumbling facades or broken windows will be less desirable to potential buyers and tenants.

- Interior condition: The interior condition of an abandoned skyscraper is also important. Buildings that have been stripped of their fixtures and finishes will require more investment to redevelop.

- Environmental contamination: Abandoned skyscrapers may be contaminated with hazardous materials, such as asbestos or lead. This can make redevelopment difficult and expensive.

By carefully assessing the condition of an abandoned skyscraper, investors can make informed decisions about whether or not to purchase the property.

3. Zoning

Zoning plays a critical role in the context of abandoned skyscrapers for sale. It refers to the regulations and restrictions imposed by local governments on the use of land and buildings within specific areas. These regulations can have a significant impact on the redevelopment potential and value of abandoned skyscrapers.

- Permitted Uses: Zoning laws determine the types of uses that are allowed within a particular zone. For example, a skyscraper that is located in a zone designated for residential use may not be suitable for conversion into a commercial property.

- Building Height and Density: Zoning laws may also restrict the height and density of buildings within a particular zone. This can impact the redevelopment potential of abandoned skyscrapers, as it may limit the number of units or the amount of commercial space that can be built on the property.

- Historical Preservation: Some abandoned skyscrapers may be designated as historical landmarks, which can restrict the types of changes that can be made to the building. This can make it more difficult and expensive to redevelop these properties.

- Environmental Protection: Zoning laws may also include environmental protection measures, such as restrictions on the use of hazardous materials or the preservation of green space. These measures can impact the redevelopment potential of abandoned skyscrapers, as they may require additional costs or delays.

Understanding the zoning regulations that apply to a particular abandoned skyscraper is crucial for potential buyers and investors. These regulations can have a significant impact on the redevelopment potential and value of the property. It is advisable to consult with local planning officials or zoning experts to obtain a clear understanding of the zoning requirements before making a purchase decision.

4. Legal Issues

Legal issues can have a significant impact on the sale and redevelopment of abandoned skyscrapers. These issues can include:

- Ownership disputes: In some cases, there may be disputes over who owns an abandoned skyscraper. This can make it difficult to sell the property or to obtain financing for redevelopment.

- Environmental liens: If an abandoned skyscraper is contaminated with hazardous materials, the government may place a lien on the property. This can make it difficult to sell the property or to obtain financing for redevelopment.

- Zoning restrictions: Zoning laws may restrict the use of abandoned skyscrapers. This can make it difficult to redevelop the property for a new use.

- Historical preservation laws: Some abandoned skyscrapers may be designated as historical landmarks. This can make it difficult t

o alter or demolish the building.

It is important to conduct thorough due diligence to identify any legal issues that may affect the sale or redevelopment of an abandoned skyscraper. This due diligence should include a title search, an environmental assessment, and a zoning review.

Legal issues can pose significant challenges to the sale and redevelopment of abandoned skyscrapers. However, by carefully considering these issues and taking appropriate steps to address them, potential buyers and investors can mitigate the risks and increase the chances of a successful project.

5. Environmental Concerns

Abandoned skyscrapers pose unique environmental challenges and concerns that can significantly impact their sale and redevelopment. These concerns must be carefully considered and addressed to ensure the safety and well-being of future occupants and the surrounding community.

- Hazardous Materials

Abandoned skyscrapers may contain hazardous materials, such as asbestos, lead, and PCBs, which can pose serious health risks if not properly managed. The presence of these materials can significantly increase the cost of redevelopment and may even render the building uninhabitable.

- Pollution and Contamination

Abandoned skyscrapers can also be sources of pollution and contamination. They may contain mold, mildew, and other biological hazards. Additionally, they may have been used for illegal activities, such as drug manufacturing or storage, which can leave behind toxic residues.

- Energy Efficiency

Abandoned skyscrapers are often energy inefficient due to outdated building systems and materials. This can result in higher operating costs and increased greenhouse gas emissions. Upgrading these systems to meet modern energy standards can be a significant expense.

- Waste and Debris

Abandoned skyscrapers can accumulate large amounts of waste and debris, both inside and outside the building. This can create an eyesore and attract pests and vermin. Cleaning up and removing this waste can be a costly and time-consuming process.

Addressing environmental concerns associated with abandoned skyscrapers is crucial for protecting human health and the environment. Potential buyers and investors should carefully assess these concerns and factor the costs of remediation into their redevelopment plans.

6. Development Costs

Abandoned skyscrapers for sale often come with significant development costs that must be carefully considered before making a purchase. These costs can vary widely depending on the size, condition, and location of the property, as well as the intended use after redevelopment.

- Structural Repairs

Abandoned skyscrapers may have suffered structural damage over time due to neglect or exposure to the elements. Repairing or replacing structural elements, such as the foundation, roof, or facade, can be a major expense.

- Environmental Remediation

Abandoned skyscrapers may contain hazardous materials, such as asbestos or lead, that need to be removed or encapsulated before the building can be safely occupied. Environmental remediation can be a complex and costly process.

- System Upgrades

Abandoned skyscrapers often have outdated building systems, such as plumbing, electrical, and HVAC. Upgrading these systems to meet modern standards can be a significant expense.

- Interior Renovations

Abandoned skyscrapers may need extensive interior renovations to make them habitable or suitable for commercial use. This can include

Development costs can make up a large portion of the total cost of purchasing and redeveloping an abandoned skyscraper. It is important to carefully assess these costs and factor them into the overall financial plan before making a purchase decision.

7. Return on Investment (ROI)

Return on investment (ROI) is a crucial consideration for investors looking at abandoned skyscrapers for sale. ROI measures the financial return on an investment, and it is calculated by dividing the profit gained from the investment by the total cost of the investment. In the context of abandoned skyscrapers, ROI can be a complex and challenging calculation, but it is essential for assessing the potential profitability of a redevelopment project.

There are a number of factors that can affect the ROI of an abandoned skyscraper redevelopment project. These factors include:

- The purchase price of the property

- The cost of renovations and repairs

- The potential rental income or sale price of the redeveloped property

- The length of time it takes to complete the redevelopment project

It is important to carefully consider all of these factors when calculating the potential ROI of an abandoned skyscraper redevelopment project. In some cases, the ROI may be high enough to justify the investment, while in other cases, the ROI may be too low to make the project financially viable.

Despite the challenges, there are a number of abandoned skyscraper redevelopment projects that have generated a positive ROI for investors. For example, the redevelopment of the Empire State Building in New York City generated a ROI of over 10% for investors. The redevelopment of the Willis Tower in Chicago generated a ROI of over 15% for investors.

These examples show that it is possible to generate a positive ROI on abandoned skyscraper redevelopment projects. However, it is important to carefully consider all of the factors that can affect the ROI before making an investment decision.

FAQs about Abandoned Skyscrapers for Sale

Q: What are abandoned skyscrapers for sale?

A: Abandoned skyscrapers for sale are unoccupied, often derelict high-rise buildings that are available for purchase. They can be found in cities around the world, and their sale can be a complex and challenging process.

Q: What are the benefits of investing in abandoned skyscrapers for sale?

A: Investing in abandoned skyscrapers for sale can offer several benefits, including the potential for significant returns, the opportunity to redevelop the property into a new, modern building, and the chance to contribute to the revitalization of a community.

Q: What are the risks involved in investing in abandoned skyscrapers for sale?

A: There are a number of risks associated with investing in abandoned skyscrapers for sale, including the potential for environmental contamination, structural problems, and legal issues.

Q: What are the key factors to consider before investing in an abandoned skyscraper for sale?

A: Before investing in an abandoned skyscraper for sale, it is important to consider factors such as the location of the property, the condition of the building, the zoning laws for the area, the potential for environmental contamination, and the development costs.

Q: How can I find abandoned skyscrapers for sale?

A: There are a

number of ways to find abandoned skyscrapers for sale. You can search online, contact a real estate agent, or attend a real estate auction.

Q: What are the steps involved in purchasing an abandoned skyscraper for sale?

A: The steps involved in purchasing an abandoned skyscraper for sale include conducting due diligence, negotiating a purchase price, and closing on the property.

Investing in abandoned skyscrapers for sale can be a complex and challenging process, but it can also be a rewarding one. By carefully considering the benefits and risks involved, and by taking the necessary steps to mitigate those risks, you can increase your chances of success.

Transition to the next article section.

Tips for Investing in Abandoned Skyscrapers for Sale

Investing in abandoned skyscrapers for sale can be a complex and challenging process, but it can also be a rewarding one. By following these tips, you can increase your chances of success:

Tip 1: Do your research

Before you invest in an abandoned skyscraper, it is important to do your research and understand the risks involved. This includes conducting due diligence on the property, the surrounding area, and the zoning laws.

Tip 2: Get expert advice

If you are not experienced in investing in abandoned skyscrapers, it is important to get expert advice from a real estate agent, lawyer, and/or engineer. These professionals can help you assess the risks and make informed decisions.

Tip 3: Be patient

Redeveloping an abandoned skyscraper can take time and money. It is important to be patient and realistic about the timeline and costs involved.

Tip 4: Be creative

There are many different ways to redevelop an abandoned skyscraper. Be creative and think outside the box. This could involve converting the building into apartments, offices, retail space, or a mixed-use development.

Tip 5: Be prepared for challenges

Investing in abandoned skyscrapers can be challenging. There may be unexpected costs, delays, and legal issues. It is important to be prepared for these challenges and have a plan in place to deal with them.

Summary

By following these tips, you can increase your chances of success when investing in abandoned skyscrapers for sale. Remember to do your research, get expert advice, be patient, be creative, and be prepared for challenges.

Transition to the article’s conclusion

Abandoned Skyscrapers

Abandoned skyscrapers represent a unique and challenging investment opportunity. Potential buyers and investors should carefully consider the location, condition, zoning, legal issues, environmental concerns, development costs, and potential return on investment before making a purchase decision. However, with careful planning and execution, abandoned skyscrapers can be transformed into vibrant and successful properties that contribute to the revitalization of urban areas.

Investing in abandoned skyscrapers requires a comprehensive understanding of the risks and rewards involved. By following the tips outlined in this article, potential investors can increase their chances of success and contribute to the redevelopment of these iconic structures.