Skyscraper insurance is a specialized type of property insurance that provides coverage for high-rise buildings, typically exceeding 40 stories. It protects against various risks, including fire, natural disasters, and terrorist attacks.

Skyscraper insurance is crucial because it offers financial protection for owners and investors in these iconic structures. The premiums are determined by several factors, such as the building’s height, location, and construction type. This insurance provides peace of mind and ensures that these architectural marvels can be rebuilt or repaired in the event of a covered loss.

The history of skyscraper insurance can be traced back to the early 20th century, when the construction of skyscrapers began to boom in major cities. As these buildings became taller and more complex, the need for specialized insurance coverage became apparent. Today, skyscraper insurance is an essential component of the real estate and construction industries, ensuring the resilience of these architectural achievements.

1. Coverage

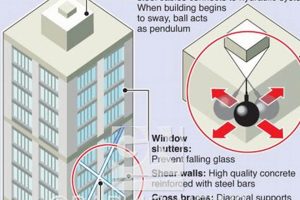

Skyscraper insurance provides comprehensive coverage against a wide range of perils that can threaten these towering structures. Fires pose a significant risk due to the extensive use of flammable materials and the difficulty in containing them at great heights. Natural disasters, such as earthquakes and hurricanes, can also cause catastrophic damage to skyscrapers. Other perils covered by skyscraper insurance include explosions, windstorms, and even terrorist attacks.

- Fire Protection: Skyscraper insurance policies include coverage for fire damage, which is a major concern due to the use of extensive glass and metal in high-rise buildings. The policies cover the cost of repairing or replacing damaged structural components, interior finishes, and contents.

- Natural Disaster Protection: Earthquakes, hurricanes, and other natural disasters can cause significant damage to skyscrapers. Skyscraper insurance provides coverage for structural damage, loss of contents, and business interruption resulting from these events.

- Other Perils: Skyscraper insurance also covers a range of other perils, including explosions, windstorms, and terrorist attacks. These perils can cause substantial damage and loss, and skyscraper insurance provides financial protection against these risks.

The comprehensive coverage provided by skyscraper insurance ensures that owners and investors are financially protected against the various risks that can jeopardize their high-rise buildings. This coverage is essential for mitigating the financial impact of catastrophic events and ensuring the continued operation of these architectural marvels.

2. Premiums

Premiums for skyscraper insurance are not fixed and vary depending on several factors related to the building itself. These factors include building height, location, and construction type, which influence the level of risk associated with the property.

- Building Height: Taller buildings pose a higher risk due to increased exposure to wind and fire, leading to higher insurance premiums.

- Location: Skyscrapers located in areas prone to natural disasters, such as earthquake zones or hurricane-prone regions, attract higher premiums due to the greater likelihood of damage.

- Construction Type: Buildings constructed using fire-resistant materials and advanced safety features, such as sprinkler systems and fire escapes, may qualify for lower premiums.

Understanding the factors that determine skyscraper insurance premiums is crucial for building owners and investors. By carefully considering these factors during the design and construction phases, they can potentially reduce their insurance costs while ensuring adequate coverage for their high-rise properties.

3. Importance

Skyscraper insurance serves as a crucial financial safety net for owners and investors of high-rise buildings. Without adequate insurance coverage, these individuals could face substantial financial losses in the event of a catastrophic event. Skyscraper insurance provides comprehensive protection against various risks, including fire, natural disasters, and terrorist attacks. This coverage ensures that owners and investors can recover their financial investment and rebuild or repair their properties if the worst happens.

For instance, in the aftermath of the 9/11 attacks, skyscraper insurance played a vital role in the rebuilding efforts of the World Trade Center. The insurance coverage provided the necessary funds to reconstruct the iconic towers and restore the surrounding area. Similarly, after Hurricane Sandy devastated New York City in 2012, skyscraper insurance helped property owners repair damage and resume operations, minimizing the long-term economic impact.

Understanding the importance of financial protection for owners and investors is paramount in the context of skyscraper insurance. It safeguards their financial interests and ensures the continued viability of these architectural marvels. Without proper insurance coverage, the financial burden of rebuilding or repairing a damaged skyscraper could be overwhelming, potentially leading to the loss of the property and significant economic consequences.

4. History

The history of skyscraper insurance is intrinsically linked to the rise of skyscrapers in the early 20th century. As these architectural marvels soared higher and became more complex, the need for specialized insurance coverage became apparent.

- Emergence of High-Rise Structures: The early 20th century witnessed a surge in the construction of high-rise buildings, particularly in major metropolitan areas like New York City and Chicago. These towering structures presented unique challenges and risks that traditional property insurance policies could not adequately address.

- Increased Complexity and Height: As skyscrapers grew taller and more intricate, the potential for catastrophic losses in the event of a fire or other disaster escalated. The increased use of steel and glass in construction introduced new vulnerabilities that required specialized insurance solutions.

- Legal and Regulatory Requirements: With the increasing height and complexity of skyscrapers, building codes and regulations evolved to ensure public safety. These regulations often mandated the provision of adequate insurance coverage to protect aga

inst potential risks. - Market Demand: The growing number of skyscraper developments created a demand for tailored insurance products that could provide comprehensive protection for these valuable assets. Insurance companies responded by developing specialized skyscraper insurance policies to meet the unique needs of high-rise building owners and investors.

The emergence of skyscraper insurance in the early 20th century was a direct response to the challenges and risks posed by these architectural marvels. As skyscrapers continue to shape skylines around the world, skyscraper insurance remains an essential tool for protecting these iconic structures and ensuring their resilience in the face of unforeseen events.

5. Legal

Skyscraper insurance plays a crucial role in ensuring compliance with building codes and regulations, which are essential for the safety and integrity of high-rise structures. These codes and regulations establish minimum standards for construction, fire safety, and other aspects of skyscraper design and operation.

- Building Safety: Skyscraper insurance policies require adherence to building codes that specify structural integrity, fire safety measures, and other safety features. This ensures that skyscrapers meet or exceed the minimum safety standards set by local authorities.

- Fire Protection: Building codes mandate the installation of fire sprinklers, fire alarms, and other fire protection systems in skyscrapers. Skyscraper insurance policies often require compliance with these regulations to mitigate fire risks and protect occupants and property.

- Zoning and Land Use: Zoning laws and land use regulations govern the height, size, and location of skyscrapers. Skyscraper insurance policies consider these regulations to ensure that the insured buildings comply with the legal requirements for their specific location.

- Environmental Regulations: Some building codes and regulations address environmental concerns, such as energy efficiency and waste management. Skyscraper insurance policies may incentivize the adoption of sustainable practices that align with these regulations.

By complying with building codes and regulations, skyscraper insurance contributes to the overall safety and well-being of occupants, communities, and the environment. It provides peace of mind to building owners and investors, knowing that their properties meet the legal requirements and are adequately protected against potential risks.

6. Customization

Skyscraper insurance policies are highly customizable to meet the unique requirements of each high-rise building. This customization ensures that the coverage provided aligns precisely with the building’s design, construction, and operational characteristics.

The customization of skyscraper insurance involves a thorough assessment of the building’s height, structural features, fire safety systems, and other relevant factors. This assessment enables insurers to tailor the policy to address specific risks and exposures associated with that particular building. For instance, a skyscraper with a complex facade may require specialized coverage for exterior cladding, while a building in a high-wind zone may need additional windstorm protection.

The practical significance of customization in skyscraper insurance lies in its ability to optimize coverage and minimize premiums. By tailoring the policy to the specific needs of the building, insurers can avoid unnecessary coverage and ensure that the policy accurately reflects the risk profile of the property. This results in cost-effective insurance solutions that provide peace of mind to building owners and investors.

7. Underwriting

In the context of skyscraper insurance, underwriting plays a pivotal role in assessing the unique risks associated with each high-rise building and tailoring the insurance coverage accordingly. Underwriters meticulously evaluate various factors to determine the appropriate level of coverage and premium for each skyscraper.

- Risk Assessment: Underwriters conduct thorough risk assessments, considering the building’s height, structural design, fire safety measures, location, and proximity to potential hazards. This assessment helps identify potential vulnerabilities and estimate the likelihood and severity of various risks.

- Building Design and Construction: The underwriting process evaluates the building’s design and construction quality, including materials used, adherence to building codes, and the presence of advanced safety features. These factors influence the building’s resilience to potential risks, such as fire, earthquakes, and windstorms.

- Occupancy and Use: Underwriters consider the building’s occupancy and intended use, as these factors can impact the risk profile. For example, a skyscraper with residential units may have different insurance needs compared to one used for commercial purposes.

- Location and Environmental Factors: The building’s location and exposure to environmental hazards, such as earthquake zones, hurricane-prone areas, or proximity to industrial facilities, are also taken into account. These factors can influence the likelihood and severity of potential risks.

By carefully assessing these factors, underwriters determine the appropriate coverage limits, deductibles, and exclusions for each skyscraper insurance policy. This ensures that the policy aligns precisely with the unique risks and needs of the building, providing optimal protection for the building owner or investor.

8. Claims

Efficient claims processing lies at the heart of skyscraper insurance, playing a crucial role in ensuring timely repairs or rebuilding efforts in the event of a covered loss. Skyscrapers, with their immense size and complexity, often require specialized contractors and materials for repairs, making efficient claims handling paramount.

Skyscraper insurance policies typically include provisions for expediting claims settlement, recognizing the urgency associated with restoring these high-rise structures. Insurers understand that prolonged downtime can lead to significant financial losses for building owners and disruption to occupants. By streamlining the claims process, insurers prioritize the prompt assessment of damages and disbursement of funds, enabling building owners to initiate repairs or rebuilding swiftly.

Real-life examples underscore the practical significance of efficient claims processing in skyscraper insurance. In the aftermath of Hurricane Sandy, which caused widespread damage to skyscrapers in New York City, insurers worked diligently to expedite claims settlements. This allowed building owners to access the necessary funds quickly, facilitating timely repairs and minimizing business interruption. Similarly, after a fire damaged a high-rise residential building in Dubai, the insurer’s swi

ft claims settlement enabled the building to be rebuilt efficiently, ensuring minimal displacement for residents.

Efficient claims processing in skyscraper insurance not only safeguards the financial interests of building owners but also contributes to the overall resilience of these architectural landmarks. By ensuring timely repairs or rebuilding, claims efficiency helps maintain the structural integrity of skyscrapers and preserve their value as assets. Moreover, it minimizes the disruption to businesses and communities that rely on these high-rise structures.

Skyscraper Insurance FAQs

This section addresses frequently asked questions about skyscraper insurance, providing concise and informative answers to clarify common misconceptions and concerns.

Question 1: What types of risks are covered under skyscraper insurance?

Skyscraper insurance policies typically provide comprehensive coverage against various risks, including fire, natural disasters such as earthquakes and hurricanes, explosions, windstorms, and even terrorist attacks.

Question 2: How are premiums for skyscraper insurance determined?

Premiums are influenced by several factors, including the building’s height, location, construction type, and the level of coverage required. Taller buildings, those located in high-risk areas, and buildings with complex designs generally attract higher premiums.

Question 3: Is skyscraper insurance mandatory?

While not universally mandated by law, skyscraper insurance is highly recommended for building owners to protect their financial interests and ensure the safety of occupants. Many lenders also require skyscraper insurance as a condition for financing.

Question 4: What are the benefits of customizing skyscraper insurance policies?

Customization allows insurance policies to be tailored to the unique characteristics of each skyscraper, ensuring that coverage aligns precisely with the building’s design, construction, and operational features. This optimization can result in cost-effective solutions and broader protection.

Question 5: How does the claims process work for skyscraper insurance?

Skyscraper insurance policies prioritize efficient claims processing, recognizing the urgency associated with repairing or rebuilding these complex structures. Insurers work diligently to assess damages and disburse funds promptly, minimizing disruption and financial losses.

Question 6: What are the key considerations for businesses when selecting skyscraper insurance?

Businesses should carefully evaluate their specific risks, including occupancy and use of the building, potential business interruption, and the financial implications of a covered loss. Seeking professional advice from an insurance broker or agent is recommended to secure appropriate coverage.

Summary: Skyscraper insurance plays a crucial role in safeguarding these architectural marvels and the businesses and communities that rely on them. Understanding the coverage, premiums, and claims process is essential for informed decision-making. By carefully considering the unique characteristics of each skyscraper, insurance policies can be customized to provide optimal protection, ensuring resilience and peace of mind.

Transition: The following section explores additional aspects of skyscraper insurance, delving into its historical origins and the role of underwriting in risk assessment and coverage determination.

Skyscraper Insurance Tips

Skyscraper insurance is a specialized and crucial form of property insurance that protects high-rise buildings against various risks. Here are several tips to consider for effective skyscraper insurance management:

Tip 1: Understand Your Coverage

Familiarize yourself with the specific perils covered under your skyscraper insurance policy. Common coverages include fire, natural disasters, explosions, and terrorist attacks. Ensure that the policy aligns with the unique risks and potential vulnerabilities of your building.

Tip 2: Optimize Premiums

Work closely with your insurance provider to identify ways to optimize your premiums. Factors such as building design, safety features, and risk mitigation strategies can influence premium costs. Explore discounts and incentives offered by insurers for implementing proactive safety measures.

Tip 3: Customize Your Policy

Skyscraper insurance policies can be customized to meet the specific needs of each building. Consider factors such as building height, occupancy, and construction materials when negotiating coverage. A tailored policy ensures that you have the right protection without paying for unnecessary coverage.

Tip 4: Maintain Accurate Building Records

Keep detailed records of your building’s construction, maintenance, and safety upgrades. These records serve as valuable documentation in the event of an insurance claim. They demonstrate your commitment to risk management and can expedite the claims process.

Tip 5: File Claims Promptly

In the event of a covered loss, notify your insurance provider promptly. Timely claims filing initiates the claims process and ensures that you receive the necessary support and compensation. Provide clear documentation and evidence to support your claim.

Tip 6: Consider Business Interruption Coverage

Skyscraper insurance can be extended to include business interruption coverage. This coverage provides financial protection against loss of income and additional expenses incurred due to a covered event that disrupts your business operations.

Tip 7: Regularly Review Your Policy

Schedule regular reviews of your skyscraper insurance policy to ensure that it remains up-to-date and aligned with your evolving needs. Changes in building occupancy, renovations, or risk exposures may necessitate adjustments to your coverage.

Tip 8: Work with a Reputable Insurer

Partner with an experienced and reputable insurance provider that specializes in skyscraper insurance. They can provide expert guidance, tailored solutions, and responsive claims handling to safeguard your high-rise asset.

Summary: Effective skyscraper insurance management involves understanding your coverage, optimizing premiums, customizing your policy, maintaining accurate records, filing claims promptly, considering business interruption coverage, regularly reviewing your policy, and working with a reputable insurer. By following these tips, you can ensure that your skyscraper is adequately protected against potential risks, minimizing financial losses and ensuring the continuity of your business operations.

Transition: Understanding the nuances of skyscraper insurance is essential for building owners and investors. The following section explores the history and evolution of skyscraper insurance, providing insights into its significance in modern-day risk management.

Skyscraper Insurance

Skyscraper insurance plays an indispensable role in the protection and preservation of these towering architectural achievements. It provides comprehensive coverage against a wide range of risks, ensuring financial resilience and peace of mind for building owners and investors. The premiums, coverage, and claims processes are carefully tailored to the unique characteristics of each skyscraper, ensuring optimal protection. By understanding the nuances of skyscraper insurance, building owners can make informed decisions and secure the necessary coverage to safeguard their valuable assets.

As the skylines of cities continue to evolve, skyscraper insurance will re

main a critical tool in managing the risks associated with these iconic structures. It enables the construction and operation of these architectural marvels, supporting economic growth and innovation while ensuring the safety and well-being of occupants and communities. By embracing the principles of risk management and comprehensive insurance coverage, we can ensure the continued prosperity and resilience of our urban environments.